Warren Buffett’s Favorite Metric

Posted on Saturday, March 5th, 2016

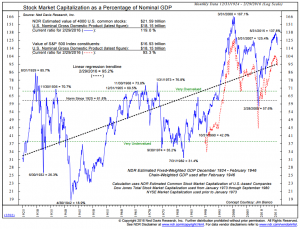

Warren Buffett’s favorite metric for the market over the years has been the Ratio of US Market Capitalization to United States GDP. Here is a copy of it below from Ned Davis Research. Ned Davis Research is one of the best independent research outfits in the business and I have followed their insights for over 25 years. http://www.ndr.com/publications

What I find fascinating about this chart is the high levels of valuation since the mid 1990’s. I believe that this time period should be considered the Golden Age of Central banking. This was the Era of Greenspan and the Greenspan Put. Alan Greenspan was the Chairman of the US Federal Reserve Bank from 1987-2006. It was Greenspan that realized the power of central banking. Central bankers in previous eras did not have the tools at their disposal to manage monetary policy as effectively as Greenspan. It was the removal of the Gold Standard by Richard Nixon which allowed central bankers in the US to pull forward growth in order to manage downturns more effectively. Note however that since 1995, valuations in the market have exceeded the average levels consistently with the exception of the 2008 crash. That leaves us with some very big questions. How long can central bankers keep pulling forward returns? How long will markets continue to give higher than normal valuations to markets based on central bank policy?

The one era most like our current one is that the late 1936 – early 1937 period. Current high levels of Price Earnings ratios, and, historically low 10 Year yields combine in a disturbing stew now as they did in 1937. Coming out of the Great Depression Federal Reserve officials saw prices in the stock market build to uncomfortable levels and with inflation on the horizon began to raise interest rates. The first tightening in August 1936 did not hurt stock prices or the economy, as is typical.

The tightening of interest rates was made worse by currency wars as European nations chose to move in the opposite direction of US monetary policy. The world began to demand US Dollars and gold. As inflation picked up to 5% the Federal Reserve raised rates further in March of 1937 and again in May 1937. This tighter monetary policy reduced liquidity and sent bond and stock prices much tumbling. Stocks would bottom a year later down 50% from prior levels.

Given the high level of valuations in the Golden Age of Central Banking how will assets perform if the Federal Reserve wants to exit the policies that brought forth those valuations? Central bankers may find that The Golden Age of Central Banking may give way to the Roach Motel of Central Banking. They can get in but they cannot get out. It’s all about how markets react to the second and third rate hikes.

In our last blog post we mentioned the key levels for the market and now we are there. The bulls did not have much trouble surmounting the 1940 level but 2000 may prove more difficult.

The next level for the bulls is the 2000 number on the S&P 500 and then 2020. We have a confluence of moving averages and resistance zones to overcome here but the bulls have the bears on the run and shorts are covering as they feel the pain. The risk at the moment is skewed to the downside as we have come very far very fast since the lows of 1812 in mid February. The market is extremely overbought and needs to rest. Let’s see if the bears can push back the bulls. Markets are looking for central bank intervention and if not from China this weekend then perhaps the ECB next week. Shorts are feeling the pain and the bulls may have their hearts set on 2100 on the S&P

Clients have been asking what metrics we are looking at as far as taking more equity risk. The 200 Day Moving Average (DMA) is the Maginot Line when it comes to seeing markets as bull markets or bear markets. Obviously, we would take more equity risk if we felt that we are in a bull market. Currently with the S&P 500 below its 200 DMA we are inclined to believe that we are in a bear market and continue to hedge risk. Let’s see if the bulls can get above and stay above the 200 DMA.

Oil’s bounce is alleviating pressure on borrowers and drillers but prices need to get back above $50 a barrel to really stop the pain. Forced selling of oil and oil related debt may be easing for now but the pain may only be delayed. High yield debt has seen money pour into that sector in the last week. Investors may be catching a falling knife there with more pain to come.

In our last blog post we asked you to keep an eye on gold. We feel that foreign investors could find solace here as the games of currency wars and negative interest rates heat up. That continues to be the case. Gold has been the star of 2016 and this week was no different. The yellow metal may be due for a rest but it might a short one. Negative interest rates in Europe are helping as are the concurrent currency wars between Japan, China, the US and Europe. Hold on tight and keep an eye on gold. Ray Dalio was at the University of Texas this week telling retail investors that they should consider holding 5% of their assets in gold. Look at Sprott Physical Gold Trust (PHYS) ETF and SPDR Gold Trust (GLD) ETF if you are determined to hold gold in your portfolio. PHYS has had better performance this year than GLD.

Not recommendation just information. Investing is not a game of perfect. It is a game of probabilities.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.