Ride the Wave

Posted on Saturday, March 19th, 2016

So much has happened and so much to talk about. We could talk about the seemingly globally coordinated easing from central banks around the globe. Central banks easing policy in the last two weeks have included Norway, Sweden, the Bank Of Japan (BOJ), the European Central Bank (ECB), the Chinese central bank and of course our own recent dovish statement from the US Federal Reserve,. We could talk about how that has led to a weaker US Dollar which in turn has helped oil, precious metal and emerging markets stage a turnaround in fortunes. Or perhaps we should discuss how Central bank maneuvers have helped US markets regain all of the ground they had lost so far in 2016.

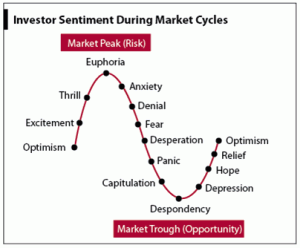

We could talk about all this but here is what we think would be most useful right now. The key to making money in these markets lies in Investor Psychology. How we understand it and our own emotions when it comes to investing our money is the key to success. Here are two charts that can help you be more successful in understanding how emotions play a role in your investing process. The first shows two 12% rallies in the last 7 months. The second is a chart of investor psychology. After our second 12% rally in 7 months you should ask yourself, Where are you on this chart? Are you relieved? Optimistic? Thrilled? Sell risk when prices are rising and buy risk when prices are falling. Understanding and keeping your emotions in check is the key to making money in markets like these. Ride the wave.

Be fearful when others are greedy and greedy when others are fearful. – Warren Buffett

If the Dow Jones holds its gains for the next two weeks we will have seen the biggest quarterly comeback in stock markets since 1933. We don’t have to remind you that the 1933 rally took place smack in the middle of the Great Depression. Risks are rising after our second 12% rally in months. It is going to be hard to move higher from here but don’t bet against continued central bank largesse. The stock market is up 12% in 26 trading days. Not bad. But it does remind us of a blog post from back in October of 2015.

October 2015 will go down as the best performing month for the S&P 500 in four years. I think that we all enjoyed the ride back up in October. The S&P 500 rallied 8.3% and followed through with more gains today to get the S&P 500 into the plus column for 2015. Those gains would be nice gains for an entire year – never mind a month! Whenever we get to thinking how much we have gained we cannot help but to contemplate the downside. We must always be on guard to temper our greed/ego just as much as we would concentrate on opportunity when fear strikes.

As a reminder the S&P 500 closed October of 2015 at 2080. It would be 10% lower by January of 2016.

Central bank policy in Europe and the US is having the same effect. Earnings estimates are heading lower while stocks ride higher. Not a great recipe for success. Risk is rising.

We cannot predict with 100% accuracy every move in the market but what we can do is try and profit by tactically allocating and hedging our portfolio in times of market stress to take advantage of market volatility. Investing is not a game of perfection but of managing the risk inside one’s portfolio. We do not jump in and jump out of the market wholesale. By divesting ourselves of overpriced assets and availing ourselves of opportunities when prices are low allows us to take advantage of the long term benefits that the math of compounding brings.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.