Place Your Bets

Posted on Sunday, February 7th, 2016

Speaking to clients this week all the talk was about the Super Bowl, the election and how far markets have to fall. First of all, let’s just get the Super Bowl talk out of the way. We are of the sentimental type and are wishing that as this is Peyton’s Manning’s’ last rodeo we hope that he gets to go out on top. Having said that Barack Obama is in his last rodeo as Commander in Chief and statistically speaking, last rodeos by second term President have never been very good for markets.

Markets hate uncertainty. By not knowing who will occupy the White House in January market participants do not know where to place their bets. According to Sam Stovall over at S&P IQ the fourth year of a second term President is up only 44% of the time versus the average year of being positive 66% of the time. The returns, as you might expect, are also subpar. The average fourth year of a second term US President is down 1.2% versus the average stock market return of 7% since 1900. If the market players do not know who is going to be President they do not know where to place their bets. For example, if a Democrat were to occupy the White House in January market players may bet on wind and solar. If, on the other hand, a Republican is in the White House beaten down coal companies might be a good bet. So you see it is not Hilary vs. Trump that has the market in a tizzy. It is the uncertainty. The market is agnostic on the race for the White House. It just wants to know which way to bet.

We have said in prior posts that it is really all about the Federal Reserve policy unwind that is moving markets but it does have other co-conspirators. The other underpinnings of doubt are the race for the White House, China and the price of oil. As those underpinnings become resolved the market can regain its footing because in becoming resolved they may precipitate a sharp fall in asset prices which could change Federal Reserve polices.

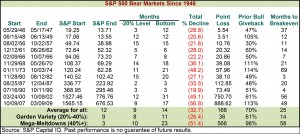

How far could prices fall? Again from Sam Stovall, we see some excellent statistical information in the following graph. A bear market is conferred when stocks fall 20% from their peak. The peak of our current market was seen on May 21st of 2015 at the price level of 2130 on the S&P 500. The average bear market since the end of WW II falls 32.7% while taking 9 months to fall 20% and 14 months to eventually hit its bottom.

Looking at Mr. Stovall’s chart what stand out to us is the 1968 – 1982 period. Much as the 1966-1982 period we believe that we are in a secular bear market. Much like the 1966-82 secular bear we have had two Mega Meltdowns. If history does not repeat but rhyme we could enter our third cyclical bear market of the 2000-2018 secular bear market and we would expect it to mimic the 1980-1982 bear market. We believe that we may be entering what S&P IQ would term a Garden Variety bear market. Those averages would call for a 26.4% down move from the peak that would last 14 months in duration. The 1980 bear market lasted 20 months and was lower by 27.1% from its peak. Numbers such as those would put our markets at 1555 on the S&P 500 in July of 2016.

We are not finding many bulls in the market right now. That alone tells us that investors are prepared after two Mega Meltdowns in the last 16 years. If we are to have a bear market we think it far likelier that we will have one of the Garden Variety and this summer investors may have a better idea of where to place their bets.

As investors we create scenarios and try to invest appropriately. Using this information we have had lower than normal equity allocations and higher than average cash positions. We are also currently hedging our equity allocations for our more aggressive clients. That should allow us to outperform in a down market. Remember, markets go down far faster than they go up. We are not making predictions here. Investing is not a game of perfect. It is a game of probabilities.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.