Party Over?

Posted on Sunday, May 8th, 2022

Diane and I have been on a health kick since the pandemic started. I say health kick – I mean we have been more aware of what we are eating, our weight and trying to get to the gym. It is just an effort to keep fit. Diane got it started when she lost 30 lbs during the stay at home portion of the pandemic. I have noticed lately that my weight has been yo-yoing up and down. Then it hit me. Since my daughter moved out every time the kids come home we treat it like it is a party or a holiday and I eat accordingly. Two weeks ago I gained 5 pounds only to lose 6 pounds the next week. Well, after today the party is over.

If you have read us for awhile you know that we have read John Mauldin’s weekly note for over 20 years now. In this week’s note he has some space dedicated to Morgan Housel. If you don’t know Morgan you should. He wrote a truly excellent book called the Psychology of Money. Get it for your kids. It is an easy read full of pure wisdom. Here is what John picked out of a recent speech from Morgan.

Housel: What Moves the Needle

We like to think investing is all about data and numbers. Those are indeed important, but we’re still human. We make decisions intuitively and sometimes emotionally. What goes on inside our heads is critically important, and no one describes it better than Morgan Housel. Morgan opened with a story about two investors: one a simple working person who spent her entire life with no apparent wealth, basically living at what could be described as poverty level. Then she died at 100 and turned out to have been a multi-millionaire. The other was a highly educated, pedigreed executive who retired in his 40s with a great fortune… which he soon lost in bankruptcy.

Good investing is overwhelmingly just about how you behave. It’s about your relationship with greed and fear, how gullible you are, who you trust, who you seek your information from, your ability to take a long term mindset, long-term time horizon. That’s what actually matters. That’s what moves the needle more than anything else.

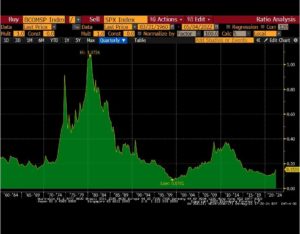

Energy stocks and gold are helping the portfolio beat our benchmarks. Will they continue? Energy companies have learned their lessons over the years. In the past they would be pumping oil as fast as they could to take advantage of high prices. That would lead to rising capex costs just in time to see prices fall. The old saying is the cure for high oil prices is high oil prices. They are not making the same mistake this time. You can see from the chart that we may be at the very beginning of a commodity super cycle. Don’t get fooled by this chart from Bloomberg though. It isn’t all good. It could also mean that as commodities rise stocks fall.

I don’t know if the party is over in the stock market but it sure has been yo-yoing up and down. We told you months ago we are in an 18 month trading range and a bear market. Our options research has been spot on and has helped us navigate through the markets twists and turns. We are still in negative gamma and that works both ways – big moves up AND down. So far, our trading range is holding. Right now, the options market is pointing to strong support at 4050 -4000 on the S&P 500. We closed at 4123 on Friday. The next chance for the market to get a clean slate and move back into positive gamma is May 20th. We would add risk at the bottom end of the range and sell rips higher. Positive gamma would help settle things down a bit. Patience is the key. Sending early today. Gotta call mom. Happy Mother’s Day!!

“Short term volatility is greatest at turning points and diminishes as a trend becomes established.”– George Soros

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.