Chill in the Air

Posted on Sunday, October 14th, 2018

God, I love Fall. There is a Chill in the air, college football on television and the stock market gets really interesting. A chill wind blew through the markets this week. If you read our Quarterly Letter last week you know that we said that the selloff could come at any moment and come quickly. We will file that under the blind squirrel theory. We are not saying that we predicted it. No one can predict the market but what we were saying is that all of the elements were there for a sharp selloff. We didn’t know which grain of sand would cause the avalanche but we knew that we were due.

Having said that, we are now sitting in what appears to be a very large trading range on the S&P 500 of 2600-2850. 2600 was support back in early 2018 and we may get a chance to revisit that level. On Friday we closed right on the all important 200 Day Moving Average (DMA). Why is the 200 DMA important? Many investors base their bull/bear debate on where we are in reference to the 200 DMA. A sustained break below the 200 DMA could bring further selling pressure on stocks. The 200 DMA has become even more important in recent years as the quants have taken over. These markets are now controlled by computers and those computers are programmed by math guys. Things like standard deviations and moving averages make up the major building blocks of those lines of computer code. A break below the 200 DMA could produce more selling. It’s just math.

We came within 44 points on the S&P from 2666. If you remember our previous writings we have written a bit on the levels that the S&P has struggled at 2x, 3x and now 4x the low of 666 in 2009. 4x 666 is 2664. We have typically spent 9-18 months struggling at those levels. Is the market still digesting 2666 (Level 4x)? If so, we are in month 11. Read it here.

Right now the pundits are saying that there is a complete disconnect between what the stock market is doing and what the economy is doing. They are correct. The economy is flying on deregulation, tax cuts and fiscal stimulus so the Fed is raising rates and tightening policy. That’s the way it works. They are taking away the punch bowl as the party is getting a little too rowdy. The Fed knows it needs to raise rates and shrink its balance sheet so that it has some weapons to combat the next crisis. What we need to know is how much pain is the Fed willing to endure as asset markets re-price in the new landscape? We would have to say that, given the lack of commentary this week from the Fed on that subject, the line in the sand at which they will defend the stock market is lower than here.

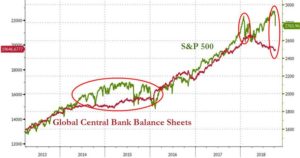

This is probably the most important chart on Wall Street right now. This is where the S&P should be priced based on the world’s central bank balance sheets. The chart seems to be telling us that the S&P 500 should be a bit lower at 2500. As the world’s central bank balance sheets are reduced so will the S&P 500 reduce.

I could go into so many reasons for last week’s 4% drop in the markets. At the end of the day it doesn’t matter. What matters is where are we going next and how do we profit? We think that we have entered a very large trading range between 2600-2850. Markets are short term oversold and due for a bounce but there seems to be a reluctance on the part of investors to jump in here. Markets are still sporting sky high valuations and the bulls will want to see new highs before committing more capital. Keep your wallet on your hip and look both ways. We could see a bounce but I think that investors will be raising cash. We could give back 20% and still only be back to where we were in mid 2017.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.