Waiting on the Fat Pitch

Posted on Saturday, August 16th, 2014

Geopolitics continue to call the tune as markets move on every twitter feed out of the Ukraine. The movements of troops are moving the troops on Wall Street as nervous investors look to stay ahead of the machination of politicians in the eastern bloc. This is the nervous time of year after all. Investors are very cognizant that summer markets are very thin and can move on very little news as traders sun themselves on beaches before the kids head back to school. Back to school usually brings some sort of stress test as Se[ptmeber and October have a history of ugly turns in the market. It is no wonder we are seeing investors such as George Soros and David Tepper hedge long positions in the stock market. With valuations at such high levels, troops at high alert and investors highly anxious about what the fall may bring it may be a prudent strategy to continue to build investing defenses. Even Warren Buffet who hates carrying substantial amounts of cash on his books is currently at his highest level of cash in over 40 years. http://www.bloomberg.com/news/2014-08-04/buffett-waits-on-fat-pitch-as-cash-hoard-tops-50-billion.html

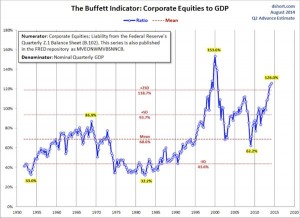

One of Mr. Buffett’s investing axioms is, much like a baseball batter with unlimited strikes might do, is to wait for the fat pitch. With over $50 billion on hand at Buffett’s Berkshire Hathaway that is one fat pitch indeed. Below by way of dshort.com comes Buffett’s favorite market indicator – Market Capitalization to GDP. As a signal the market is overbought when the indicator breaks 100% and is oversold when it goes below 60%. We are currently at 126% of GDP. Markets can advance farther than one thinks but this indicator is certainly flashing a yellow caution light.

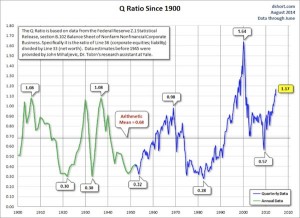

The above chart, also from dshort.com, is the Q Ratio. The Q Ratio was developed by James Tobin, Nobel Laureate from Yale University. The Q Ratio measures the combined market value of companies to their replacement cost. A ratio below one indicates that the value of the company’s stock is cheaper than replacement cost while a ratio higher than one indicates that the company’s stock value is higher than the replacement cost. From this one can see that markets and investors don’t listen to yellow caution lights and sometimes just sail on through. The Internet Bubble of 2000 pushed right on through the highest levels of Q Ration ever recorded. Flashing caution at over 1.0 this metric currently stands at 1.17. High levels but one does not know when a bubble breaks.

Having aid that we do believe that the Federal Reserve’s action of continued monetary policy have induced these high levels of asset prices. Any further reduction in monetary heroin may induce less than euphoric feelings from the marketplace. In July the reduced asset purchases began to have an effect on markets and those purchases are planned to cease in October of this year. We continue to expect volatility to increase into that time frame and prepare for the opportunities that may rise from the change in monetary policy.

Equity markets have seen increased volatility, which from our perspective, limits upside potential in markets. Equity markets have seen higher upside since 2008 when markets are stable and not volatile. We believe that this volatility will continue into the fall of 2014. The Ukrainian situation and Portuguese banking crisis presented volatility and a selloff of risk in equity markets. That extended selloff was afforded a bounce in prices this past week. That bounce may have run its course. Friday’s action in the market provided clues that the bulls short run has ended as bears took control in the afternoon on Friday at critical resistance points. This week may be critical in the future near term course of the market as everyone awaits Janet Yellen’s Jackson Hole speech on Friday.

We continue to use small caps as our map while US Treasuries and Gold continue to be our risk temperature gauge. For the moment 1960/68 is key resistance in the S&P 500. If the bulls can leap above this level the run can continue. On the downside, the Russell 2000 needs to hold 1100. Also keep an eye on the VIX index. As it spikes the Fed may try to calm fears.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.