4 Am Wake Up Call

Posted on Sunday, December 8th, 2019

Our return from Thanksgiving break was certainly an interesting one. Right off the bat we saw an almost 850 point drop in the Dow Jones from Black Friday until Tuesday as President Trump was quoted as saying that he saw the chances of a trade deal lessening. Markets were bailed out by a 4am anonymously sourced report that trade discussions were back on. You can’t say that this market isn’t interesting.

The tariff deadline is set for a week from today – December 15th. We expect it to pass without any grand gestures. The key to this game seems to be delay, tweet and delay some more. The Chinese are not inclined to make a deal. The Chinese government thinks in terms of decades and centuries – not the next news cycle and tomorrow’s stock market open. As far as the Chinese are concerned they have the view that Trump may be out in a year so why should they help him by making a deal. The Chinese do need to keep talks alive as they require more pork than they can get their hands on as a vicious swine fever has culled their herds. China produces half of the world’s pork supply and pork is the most consumed meat in the country. Back in the 1990’s when obtaining our Political Science degree it was common knowledge that the most feared situation in the Chinese Communist party was unrest and rebellion among its immense population. The most dangerous event would be if something happened to their pig herds and the availability of pork. Empty bellies lead to rebellion. Alfred Henry Lewis, the American novelist, once said that only 9 meals separate mankind and anarchy.

The Chinese will delay and Trump will bellow. The jobs report on Friday bought Trump more time and has given him more leverage over the Chinese. The jobs report should also put the Fed at ease concerning the trade war and the economy. The Fed will, however, keep plying the market with QE4 until the second quarter of 2020. We would warn you that we would expect that an announcement of a Phase Trade One deal would negatively impact the market. Buy on the rumor(s) and sell on the news.

There was a chart making the rounds this week in reference to the Fed balance sheet and stock market performance. The chart implies, and we agree, that, as goes the balance sheet so goes the market. In the past nine weeks the Fed’s balance sheet has grown in eight of them. Of those nine weeks only one week saw a lower stock market. I will let you guess which week was lower.

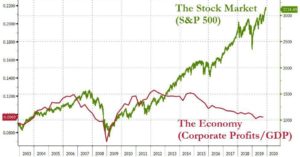

Equity valuations keep soaring and are now in the top 10% of all time rivaling the Dot Com Era of 2000-2001. That era also had the Fed stuffing money into the system ahead of Y2K which led to the expansion and bursting of the Dot Com Bubble. Why our obsession with valuations? From valuations we can extrapolate future returns. Higher valuations imply lower future returns. Central bankers continue to push rates lower and pour money into the system pressing asset prices higher. Check out the following chart from Zero Hedge.

In the past 5 years, the S&P 500 stock index has risen over 50% and during that period operating profits for non-financial companies have declined over 15%, a drop that has always been associated with economic recessions.

Source: Bloomberg

The Fed is pushing money into the system at a rate equal to QE1 when there was a crisis at hand. Central bankers are planning on keeping the money spigot open in 2020. It should continue to push asset prices higher as long as investors don’t lose confidence in the Fed. The music is playing. Dance closer to the door.

I think we aspire less to foresee the future and more to be a great contingency planner… you can respond very fast to what’s happening because you thought through all the possibilities, – Lloyd Blankfein

To learn more about us and Blackthorn Asset Management LLC visit our website at www.BlackthornAsset.com .

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. – Winston Churchill

Disclosure: This blog is informational and is not a recommendation to buy or sell anything. If you are thinking about investing consider the risk. Everyone’s financial situation is different. Consult your financial advisor.